Featured

Table of Contents

As soon as you have actually located the ideal remote treatment task, it's time to prepare your virtual method for success. Below are the vital aspects to think about: Obtain a trustworthy, high-speed internet connection (at least 10 Mbps), a computer or laptop that meets your telehealth system's needs, and a premium web cam and microphone for clear video and audio.

Establish apart a quiet, exclusive area or space for your teletherapy sessions. Guarantee the location is well-lit, with a non-distracting history that represents your specialist setting. Use noise-reducing strategies and keep privacy by avoiding disruptions during sessions. Change your therapeutic style to the digital environment. Usage active listening, keep eye call by checking out the cam, and focus on your tone and body movement.

Functioning from another location removes the demand for a physical workplace space, cutting prices associated with rent, energies, and maintenance. You also conserve money and time on commuting, which can lower stress and boost total wellness. Remote therapy boosts access to care for customers in rural locations, with minimal wheelchair, or dealing with various other obstacles to in-person treatment.

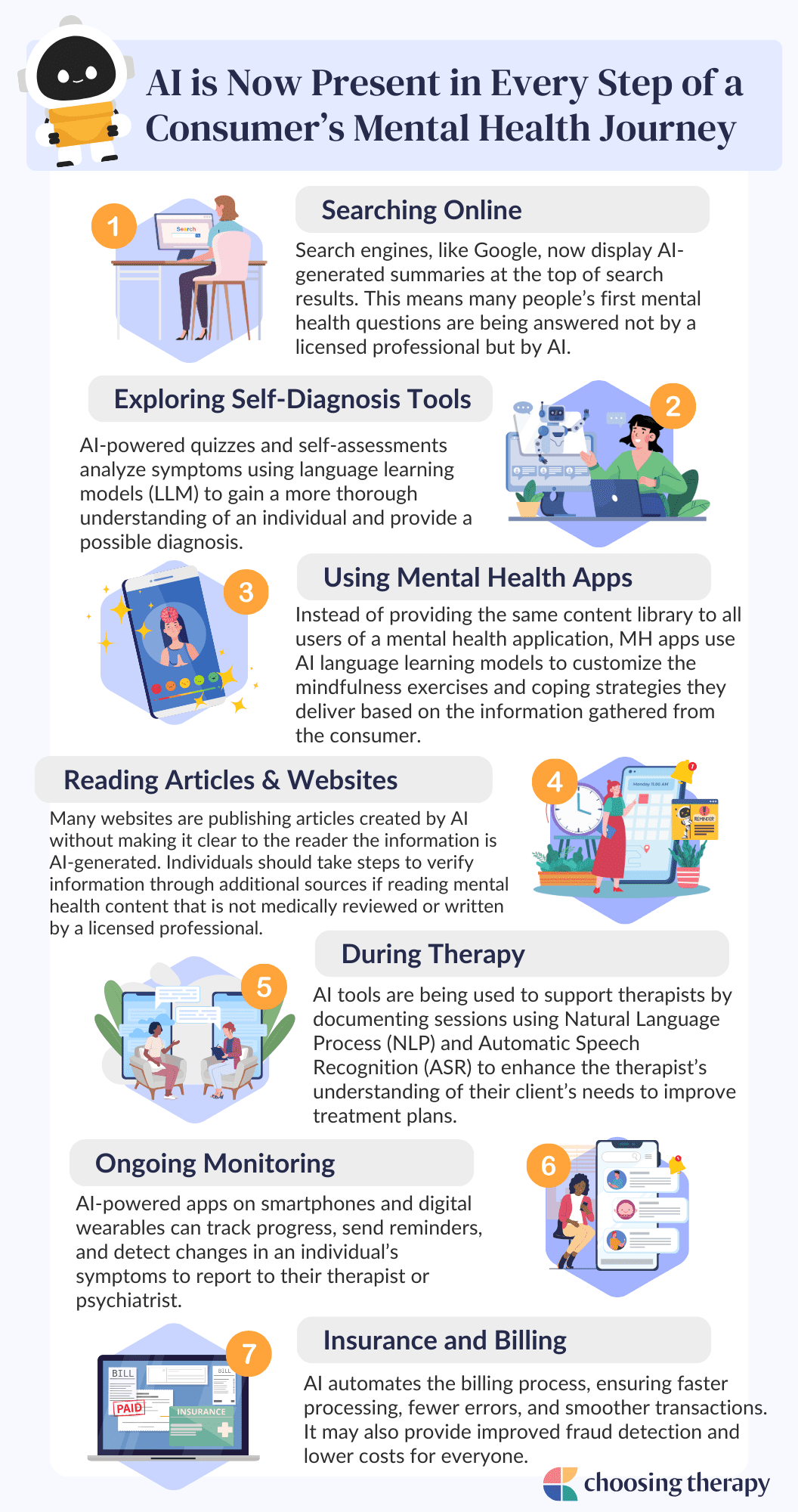

The Ideal AI Use Cases

Working from another location can in some cases really feel isolating, doing not have face-to-face communications with associates and clients. Handling customer emergency situations or crises from a range can be hard. Telehealth requires clear methods, emergency situation get in touches with, and familiarity with neighborhood resources to make certain client security and ideal care.

Each state has its very own laws and regulations for teletherapy method, including licensing requirements, informed consent, and insurance policy reimbursement. To thrive lasting as a remote specialist, emphasis on expanding professionally and adapting to the changing telehealth atmosphere.

Why Connection Matters More Than Ever

A crossbreed design can give versatility, lower screen tiredness, and allow for a much more progressive change to fully remote job. Try various mixes of online and face-to-face sessions to discover the ideal equilibrium for you and your clients. As you navigate your remote treatment profession, keep in mind to prioritize self-care, set healthy and balanced boundaries, and look for assistance when needed.

Research constantly reveals that remote treatment is as efficient as in-person treatment for typical mental wellness problems. As even more customers experience the ease and comfort of receiving treatment at home, the acceptance and need for remote solutions will certainly remain to grow. Remote therapists can earn affordable wages, with possibility for higher incomes through expertise, private technique, and occupation development.

Remaining Legally Compliant with AI Tools

We comprehend that it's useful to chat with an actual human when questioning website design companies, so we would certainly love to set up a time to chat to ensure we're a great mesh. Please submit your information listed below to make sure that a participant of our group can help you obtain this process started.

Tax deductions can save freelance therapists cash. If you don't understand what qualifies as a create off, you'll miss out., the Internal revenue service will demand invoices for your tax reductions.

There's a great deal of argument among entrepreneur (and their accountants) concerning what constitutes an organization meal. The Tax Cuts and Jobs Act (TCJA) of 2017 just further muddied the waters. The TCJA efficiently got rid of tax obligation deductible home entertainment costs. Since meals were usually lumped in with amusement expenses, this created a great deal of anxiousness amongst organization owners that usually deducted it.

To certify, a meal should be purchased during a company journey or shared with a business partner. What's the distinction in between a vacation and a business journey? In order to certify as company: Your journey has to take you outside your tax obligation home.

You need to be away for longer than one job day. If you are away for four days, and you spend three of those days at a conference, and the fourth day sightseeing and tour, it counts as a company trip.

You need to be able to verify the trip was intended beforehand. The IRS intends to avoid having local business owner add specialist activities to recreational trips in order to turn them into overhead at the last moment. Preparing a composed travel plan and itinerary, and reserving transportation and lodging well beforehand, assists to reveal the trip was primarily service related.

When using the gas mileage price, you do not consist of any kind of other expensessuch as oil changes or routine maintenance and fixings. The only additional car prices you can deduct are parking fees and tolls. If this is your first year owning your car, you should determine your reduction making use of the mileage rate.

Your Practical Steps

If you exercise in an office outside your home, the cost of rent is fully deductible. The expense of energies (heat, water, power, web, phone) is additionally deductible.

Latest Posts

Accelerated Relief Without Retelling Your Story

The Connection Between Chronic Stress and Mental Wellbeing

Real Talk: Overcoming the Fears